In-house legal teams can struggle to accurately predict legal spend, particularly if work is lumpy or unpredictable. Happily, the rise of legal operations and affordable legal matter management software has made this easier over the past five years, and the growth of legal data analytics continues to aid the predictability of legal spend.

Long gone are the days when in-house legal teams could operate as a black box, spending with impunity. Today the law department must be more quantitative and transparent with their legal spend management. They must take a disciplined and strategic approach so they are armed with the necessary data to communicate their spending decisions and maximize the return on investment of their legal budget.

To become an efficient, data-driven Legal Department - particularly as it relates to legal spend management - all corporate in-house Legal Departments should consider the following three techniques to manage external counsel and legal spend.

1. Use legal operations software

Tracking external legal spend is the first (and most crucial) step to managing it. In the past, legal teams were able to get by using spreadsheets to track legal spend. But, the process was time-consuming and often entailed manually sifting through paper invoices, scrutinizing line items, and bucketing costs into appropriate categories. At month or quarter end, these spreadsheets had to be laboriously manipulated to identify trends or garner any type of valuable insights. Let’s be clear, this is not what we mean by tracking your legal spend.

Modern in-house legal departments are turning to legal operations software with spend management capabilities to eliminate the manual efforts of tracking spend – all while gaining the tools for budgeting, reporting, collaborating on matters, and managing external counsel, legal vendors and knowledge across the organization.

A modern legal matter management system allows your legal team to review and process invoices more efficiently which can lead to improved legal spend management, law firm discounts, faster payment cycles, and cost reduction programs.

The right in house legal department software can transform your legal spend management. It can help your corporate legal department:

- Easily set and track budgets against actual spend

- Significantly reduce the time your lawyers have to spend reviewing legal invoices

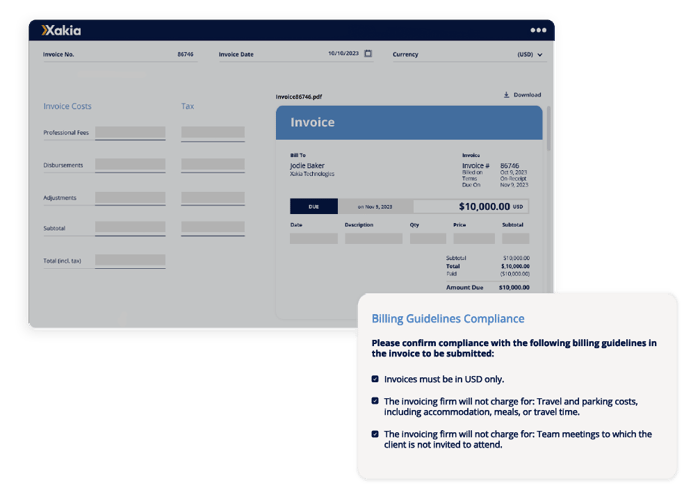

- Enforce your billing guidelines

- Provide real-time and data-driven insights to help inform decisions, identify trends and opportunities for cost savings

- Simplify communication with outside counsel and law firms

- Streamline the process for receiving, reviewing and approving legal invoices from outside counsel

2. Set billing guidelines

Billing guidelines are a great resource for helping in-house corporate legal departments manage their external spend. Focused on transparency for both the legal department and their law firm, the primary purpose of outside counsel guidelines is to set clear and consistent expectations for how your law firms should work with you. Billing guidelines detail how you expect legal matters to be staffed, how invoices should be submitted, which fees and expenses the legal department will pay for, and much more.

Billing guidelines are not one-size-fits-all and shouldn’t only be reserved for larger legal departments. Outside counsel guidelines can provide value at nearly any stage as they allow you to:

- Identify non-compliant charges from the external counsel or law firm

- Minimize errors and overpayment of outside counsel spend

- Create positive billing habits

- Enhance relationships with external counsel and law firms and create strategic alignment

- Identify vendors who consistently have issues billing you the way you expect

- They set clear expectations on how you and your law firms work together

- Saves you time on manual invoice review

With proper billing guidelines, general counsel will be happy with a more streamlined process, fewer billing errors, and greater transparency into their legal spend. Law firms will be happy to have clear direction from their customers. CFOs will be happy with a better ability to plan future expense. Everybody wins.

Tip: It's easy with a legal spend management software.

3. (The right) legal reports

Part of being a successful data-driven in-house legal department is your ability to quantify your savings and demonstrate to your C-suite and board that your efforts to transform your department from a cost center to a profit center have paid off.

Legal analytics software is crucial to this effort. Ideally, you will have a solution to track spend and produce the key metrics and legal reports you need to identify spending trends, as well as produce department, vendor, and matter-specific cost analyses. This provides concrete data to objectively evaluate law firms based on performance metrics and their ability to meet your expectations. You can identify bad partners and justify whether or not to move work to a firm better suited to meet your needs, long-term goals, and price.

A few KPIs corporate Legal Departments may want to track include:

- Overall legal spend by business unit

- Overall spend by category of work

- Vendor activity and legal costs

- Actual spend compared to budget

- Spend by strategic importance of work

- Top outside counsel firms used

Legal reporting on external resources provides a wealth of data that makes it easier to determine which matters would benefit the most from Alternative Fee Arrangements (AFAs) and gives legal departments one more lever to effectively manage external spend. A legal spend management software can help generate these reports with ease.

Start building the foundation with legal matter management software

While these are just a few of the items that can help jumpstart a legal team’s spend management efforts, they go a long way in building the foundation for financial responsibility within the organization, specifically finance, and creating greater alignment with business objectives. Download our white paper: 10 steps to a smarter legal budget to get started.

To learn how Xakia's legal matter management software can help with legal spend management, get in touch with the team for a demo today.